Occasional Form

admin 4/12/2022

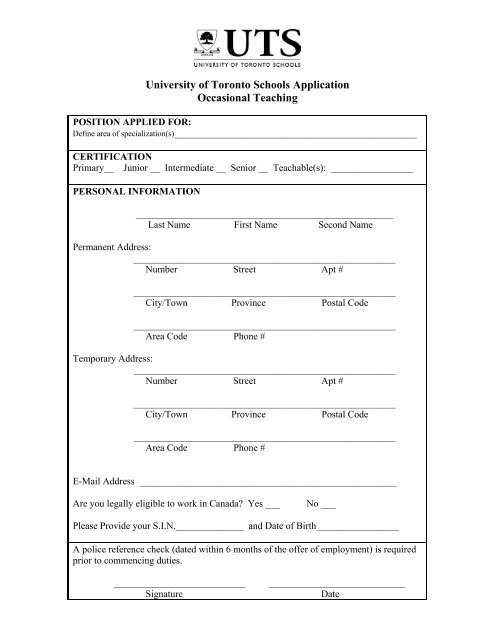

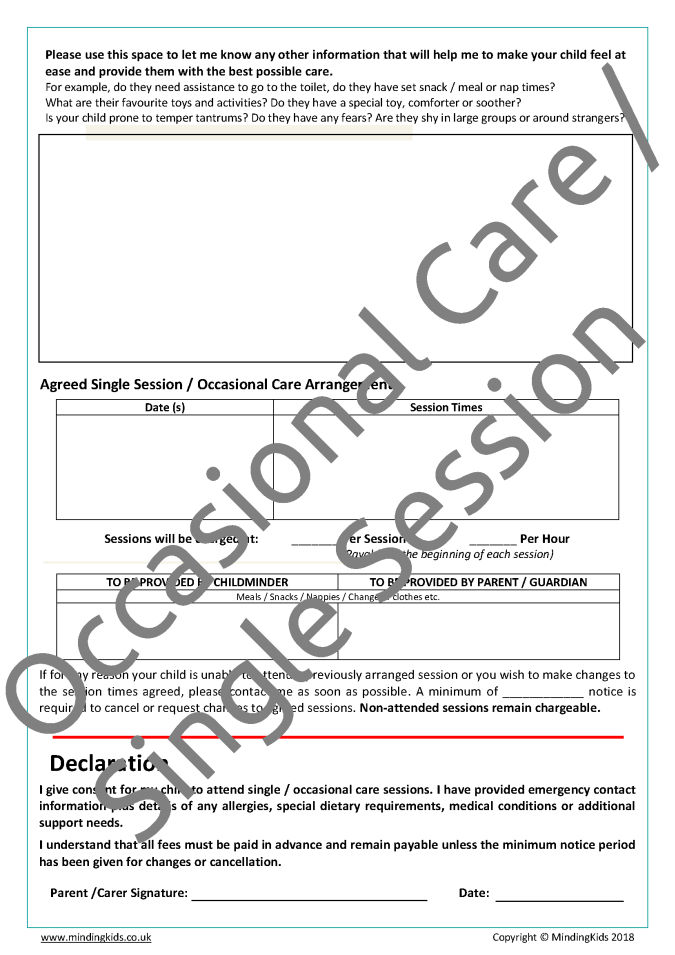

Sales & Use Tax Return for Occasional Vendors Form 43 Important Information If the form is not pre-printed with your name and address information please print your name and address in the box where indicated. If you have remitted tax to the State of Wyoming previously, please enter your Ownership RID (Revenue Identification Number) in the box. Occasional Sitter Request Form. This form is used when requesting an occasional sitter. If you are a family looking to hire a caregiver permantely, please fill out the Family Application form, instead.

Retail Sales Tax

CR 0100AP- Business Application for Sales Tax Account

DR 0100 - Retail Sales Tax Return for 2020 Filing Periods (Supplemental Instructions)

DR 0100A- Retail Sales Tax Return for Occasional Sales

DR 0235- Request for Vending Machine Decals

DR 0594- Renewal Application for Sales Tax License

DR 1290 - Certification of Registered Marketplace Facilitator

DR 1465- Retail Food Established Computation Worksheet for Sales Tax Deduction for Gas and/or Electricity

- DR 0100 - Retail Sales Tax Return

- 2018-2019 Filing Periods

- 2017 Filing Period

- 2016 Filing Period

Local Jurisdiction Sales Tax

DR 0200 - Special District Sales Tax Return Supplement

DR 0800 - Location/Jurisdiction Codes for Sales Tax Filing

DR 1485 - County Lodging Tax Return

- DR 0200

- 2017 Filing Periods

- 2016 and Prior Filing Periods

Special Event Sales Tax

DR 0589- Sales Tax Special Event Application

DR 0593 - Application for Renewal of Multiple Event Sales Tax License

Claim for Refund

DR 0137B- Claim for Refund of Tax Paid to Vendors

DR 0137C- Sales and Use Tax Refund for Broadband Equipment

Sales Tax Exemption, Non-Profits & Government

DR 0172- Contractor Application for Exemption Certificate

DR 0511- Affidavit for Colorado Sales Tax Exemption for Farm Equipment

DR 0563- Sales Tax Exemption Certificate Multi-jurisdiction

DR 0715- Application for Sales Tax Exemption for Colorado Organizations

DR 0716- Statement of Nonprofit Church, Synagogue, or Organization

DR 1191- Sales Tax Exemption on Purchases of Machinery and Machine Tools

DR 1192- Colorado Machinery and Machine Tools State Sales Tax Exemption Declaration

DR 1240- Certification for Sales Tax Exemption on Pine or Spruce Beetle Wood

DR 1260- Sales Tax Exempt Certificate Electricity & Gas for Domestic Consumption

DR 1367- Affidavit of Sales Paid by Government Credit Card

DR 1666- Sales Tax Exempt Certificate Electricity &, Gas for Industrial Use

DR 5002- Standard Colorado Affidavit of Exempt Sale

Motor Vehicle Sales Tax

DR 0024 - Standard Sales Tax Receipt for Vehicle Sales

DR 0024N - Instructions for Standard Sales Tax Receipt for Vehicle Sales

DR 0026N - Tax Statement for Leased Motor Vehicle Instructions

DR 0070 - Statement of Purchase Price of Motor Vehicle

DR 0440 - Lessor Registration for Sales Tax Collection

DR 0780 - Statement of Colorado Sales Tax Exemption for Motor Vehicle Purchase

Interstate Commerce & Heavy Weight Vehicles

DR 0201 - Overweight Vehicle Refund

DR 0202 - State Sales Tax Refund for Vehicles Used in Interstate Commerce

DR 1369 - Colorado State Sales &, Use Tax Exemption for Low-Emitting Heavy Vehicles Affidavit

Use Tax

DR 0251- RTA Consumer Use Tax Return

DR 0104US- Consumer Use Tax Reporting Schedule

Helpful Tax Forms

DR 0145 - Tax Information Designation and Power of Attorney for Representation

DR 1917 - Information for Outfitters &, Owners of Short-Term Rentals

Occasional Formula Feeding

DR 5782 - Colorado Electronic Funds Transfer (EFT) Program for Tax Payments Information

DR 5785 - Electronic Funds Transfer (EFT) Account Setup Form for Tax Payments

Occasional Foam In Urine

Please be aware fillable PDFs are for your convenience and must be printed prior to closing out the document, as changes will not be saved in the PDF. If you are looking for a Colorado sales or use tax form that is not listed on this page, please email DOR_TaxInfoEmail@state.co.us.